When it comes to multiple state withholdings, New York does something a little differently than most states. In fact, most employees that report withholdings in multiple states (when one of those is New York) usually believe there's an error on their W-2. We're here to set the record straight.

When it comes to multiple state withholdings, New York does something a little differently than most states. In fact, most employees that report withholdings in multiple states (when one of those

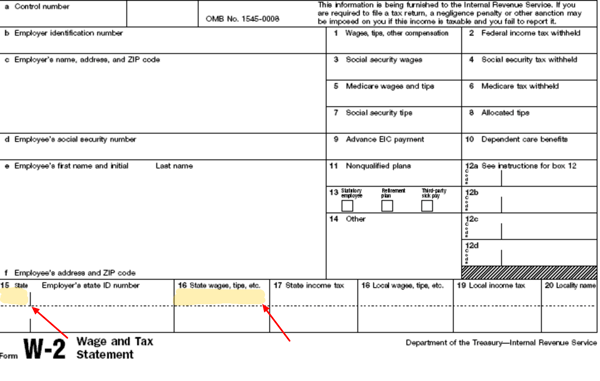

In Box 16 most states report the amount of wage that was earned in that state. So if you had state withholding in more than one state, you would see the first state listed in box 15 followed by the wage earned in that state in Box 16. Beneath that you would see the next state listed in Box 15 followed by the wage earned in that state in Box 16. When the two wage amounts listed in each of the Box 16 are added together they would total box 1 which is your Federal Wage amount.

In New York, they don’t report the total wage made in New York State, they report the total Federal wages from Box 1 in the state wage Box 16.

So, even if only 2 weeks of your yearly wage was in New York, Box 16 will show whatever is in Box 1, and if you have another state along with New York when both wage amounts from Box 16 are added together you could potentially have more than your federal wages in Box 1.

No. When filing your personal tax return in New York there is a section to explain if any of the wages you made were out of the state and how much of the wage was made in New York. This allows the state to figure out just how much wage was actually made in New York and how much tax should have been paid.

If you want to see the proof for yourself you can find the information in Publication NY-50 on page 33 under heading “Employee Requirements Concerning the Reporting of New York State Wages."

Bahar UttamSoderberg Insurance Services Inc

soderberginsurance.com

Bonnie DeneefNuttall Golf Cars Inc

tore.com

Cathy PaceFinger Lakes Wrestling Club Inc

Christina WagarDr. Christopher Mozrall

Colleen KollShear Ego Salon & Spa

shearego.com

Debbie KlymkowBoulevard Van City

vancitymobility.com

Dick EakinsNorco Farms

Don CunninghamTown of Bergen NY

bergenny.org

Eileen ReevesCatholic Charities

ccwny.org

Emily WyseWyse Properties

wyseproperties.com

Howard ClarkeH Clarke Services

John WorthTown Of Pembroke

townofpembroke.org

Kelly StephensonThe Service Collaborative of WNY, Inc.

www.tscwny.org

Paul CronkFillmore Wesleyan Church

fillmorewesleyan.church

Teresa JacksonDudley Poultry

dudleypoultry.com

Tina CanaliChemung County SPCA

chemungspca.org

Denni HarbaughIndependent Title Agency, LLC

fasttitles.com

Elvira AlettaExplore What's Next

explorewhatsnext.com

Peter VarlanMitchell T. Yencer

eyesite-ny.com

Cindy Van BurenHeritage Packaging

heritagepackaging.com

Lisa LyonsAttica Auto Supply Inc

Bonnie DeNeefNuttall Warehousing LLC

thegolfcartstore.com

Jackie AgustaSandvik & Associates Inc

sandvikandassociates.com

Jennifer PaulyThe Lower Niagara River Region Chamber

upwardniagara.com

Sue BuddHinspergers Poly Industries Inc

hinspergers.com

Gail StoweStowe Potato Sales

Nancy MillerN&G Broadway Inc

Chris SmithGrigg-Lewis Foundation

grigglewis.org

Frances SweeneyCPM Golf, LLC

deerfieldcc.com

Lora MillerTim's Trim Inc

timstrim.com

Helen CunninghamJeffrey Ellis Carl Cabinetmakers Inc.

jeccabinetmakers.com

Sally KovatchNothnagle Drilling, Inc

nothnagledrilling.com

Teri PetersLong Pond Pediatrics

longpondpeds.com

Love working with CPP. They have made life so much simpler for me.

Nicole BeginTown Of Pembroke

townofpembroke.org

Mary SutterMatrix Machine Specialties Inc

matrixmachinespecialties.com

Laura LaneLivingston County Area Chamber Of Commerce

livingstoncountychamber.com

Barbie GozelskiLeRoy Country Club

Very friendly staff, and you are always on top of the services you offer!

Nancy MillerN&G Broadway Inc

Patricia GilbertsonGLG Development Corp.

familyfurnitureperry.com

Elizabeth BarefootBarefoot Septic & Sewer Inc

barefootseptic.com

We are a Complete Payroll customer and have been very happy with our relationship. We have had no problem referring CPP to our business owner clients.

Kris DussmannCoordinated Plan Inc

coordinatedplan.com

Customer Service is awesome! Love Andrea 😀

Margaret UrlacherPittsford Realty Corp

Liz MaherDiscovery Schoolhouse LLC

discoveryschoolhouse.info

Friendly employees, lots of resources.

Marybeth SimoneitLaSalle Early Childhood Center Inc

lasalleearlychildhood.com

Kathy CassettaCassetta Agency Inc

cassettainsurance.com

Service reps are so helpful and always available. Andrea is the best!

Joe CzernyMercy Flight Inc

www.mercyflight.org/

I love our CSR Megan. She makes my life so easy. I used to be with one of your competitors and the CSR there treated me like a number. Megan treats me like she is part of my team.

Mark LoganFirst Free Methodist Church

northgatefmc.com

Patty DuganLynn-Ette & Sons Inc

lynnettefarms.com

We are a Complete Payroll customer and have been very happy with our relationship. We have had no problem referring CPP to our business owner clients.

Kris DussmannCoordinated Plan Inc

coordinatedplan.com/

Debbie BlacklockBlacklock / Eglin Enterprises, Inc.

consaulautocare.com/

If it's relevant or interesting and it relates to taking care of your people, we're publishing it.

Getting worker classification right is crucial. Misclassifying W-2 employees and 1099 independent contractor carries significant legal and financial implications. Misclassification can lead to hefty

A question we frequently encounter from New York employers is straightforward: "As an employer, can I make it mandatory that my employees use direct deposit?" It is no surprise that nearly 95% of all

On April 2, 2025, the U.S. Citizenship and Immigration Services (USCIS) released an updated version of the I-9 form. However, it's important to note that employers are not immediately required to

505 Ellicott Street

Buffalo, NY 14203

Phone: 716-482-7580

Fax: 716-482-7580

sales@completepayroll.com

7488 State Route 39

P.O. Box 190

Perry, NY 14530

Toll Free: 888-237-5800

Phone: 585-237-5800

Fax: 585-237-6011

info@completepayroll.com

130 South Union Street, Suite 205

P.O. Box 650

Olean, NY 14760

Toll Free: 888-237-5800

Phone: 716-373-1000

Fax: 716-373-1001

info@completepayroll.com