NYS Minimum Wage & Overtime Salary Thresholds

A quick, yet complete, reference guide for employers in New York State.

Introduction

New York State has recently passed incremental increases to both its minimum wage and overtime salary thresholds - determining whether certain employees will be considered exempt and non-exempt. While these increases are state-wide, when and how much they'll change depends on the size and location of your business. So we've created this quick reference guide to help you understand exactly how and when your business will be impacted by these changes.

Before You Begin

This resource was initially published in March 2018 (and will continue to be updated as needed). We want to point that out because some of the increases in both the minimum wage rate and overtime salary threshold have already begun. But as you can see, there are several additional increases scheduled over the next few years. So even though we won't be addressing increases from previous years, please rest assured that all this information is accurate and up-to-date. It will be updated should any additional changes be finalized.

NYS Minimum Wage Increases

Federal Rate

Currently, the federal minimum wage is $7.25 per hour, set and enforced by the United States Department of Labor. Of course, the minimum wage rate in New York State has long been higher than the federal level.

New York State Rate(s)

For employers in most of New York State, the minimum wage at the time of this update (January 2024) is $15 per hour.

Employers in New York City, Nassau, Suffolk and Westchester Counties

The minimum wage in these jurisdictions is $16.00 per hour, with a 50-cent increase scheduled each year in 2025 and 2026.

Employers in all other New York State counties

The statewide minimum wage is $15 per hour, with a $.50 increase scheduled each year in 2025 and 2026. This applies to employees outside of New York City and Nassau, Suffolk, and Westchester Counties, except for fast-food employees.

Employers of fast-food workers

Adding another wrinkle to these statewide minimum wage increases is the separate fast-food worker minimum wage schedule.

Effective December 31, 2018, all fast-food workers in New York City must be paid a minimum wage of $15.00 per hour. That same rate for fast-food workers will be rolled out to the rest of the state a few years later, effective July 1, 2021.

The table below provides a simple, yet comprehensive review of the incremental increases in the minimum wage for all New York State employers. You'll notice the distinction between both large and small NYC employers, employers in Nassau, Suffolk and Westchester Counties, as well as employers throughout the rest of New York State.

|

Effective Date |

NYC Large Employers (11 employees or more) | NYC Small Employers (10 employees or fewer) | Employers in Nassau, Suffolk and Westchester | Employers in All Other NYS Counties |

| 12/31/16 | $11.00 | $10.50 | $10.00 | $9.70 |

| 12/31/17 | $13.00 | $12.00 | $11.00 | $10.40 |

| 12/31/18 | $15.00 | $13.50 | $12.00 | $11.10 |

| 12/31/19 | $15.00 | $15.00 | $13.00 | $11.80 |

| 12/31/20 | $15.00 | $15.00 | $15.00 | $12.50 |

| 12/31/21 | $15.00 | $15.00 | $15.00 | $12.50 |

| 12/31/22 | $15.00 | $15.00 | $15.00 | $14.20 |

| 12/31/23 | $16.00 | $16.00 | $16.00 | $15.00 |

| 12/31/24 | $16.50 | $16.50 | $16.50 | $15.50 |

| 12/31/25 | $17.00 | $17.00 | $17.00 | $16.00 |

*Starting January 1, 2027, the state minimum wage rates will (1) be set annually by the New York State Department of Labor (NYS DOL) and (2) be published no later than October 1 of each year, with the new rate to take effect on January 1 of the following year.

What does this mean for employers?

As opposed to the overtime salary threshold increases (examined next) which are more complex in nature, the upcoming increases in the minimum wage present a much simpler proposition for employers in New York State. Employers must know which category they fall into and understand how their minimum wage rate will increase in the upcoming years. Beyond that, it's just a matter of planning for the increases and how they may impact cash flow, hiring and other administrative duties.

Helpful Articles

NYS Overtime Salary Threshold Increases

Federal Standards

Currently, according to the FLSA, the federal overtime salary threshold is $23,660 annually, calculating to $455 per week. That means that any white-collar, salaried employees earning under $455 per week must be paid overtime wages for any hours worked over 40 in a given week. Back in 2016, a proposal was floated to more than double this threshold to an annual salary of $47,476, but that was struck down by a federal judge in Texas weeks before the changes were set to take effect.

New York State Standards

Shortly after the changes to the FLSA were struck down, New York State legislature introduced increases to its own overtime salary thresholds. Unlike the proposed FLSA changes, which were set to be implemented across the board and all at once, the increases in New York State are incremental and vary based on where the employer is located - and in the case of employers in New York City, the number of employees as well.

Employers in New York City

NYC employers will see their overtime salary threshold increase to $1,125 per week, which calculates to an annual salary of $58,500, with the only distinction being between "small" and "large" employers. Businesses with 11 employees or more are considered large employers and will see their overtime salary threshold increase to $1,125 per week by December 31, 2019. Businesses with fewer than 11 employees are considered small employers and won't see their overtime salary threshold increase to the maximum amount of $1,125 per week until December 31, 2019.

Employers in Nassau, Suffolk and Westchester counties

Like employers in New York City, businesses in Westchester County and Long Island will also see their overtime salary threshold increase to $1,125 per week ($58,500 annually), but this will happen much more gradually. The overtime salary threshold will increase to $900, $975 and $1,050 each year before it finally increases to the maximum threshold of $1,125 on December 31, 2021.

Employers in all other New York State counties

As is the case with many other labor laws, New York State counties outside of the New York City metro area will see different standards when it comes to the overtime salary threshold increases. Employers in the remainder of the state will see gradual, incremental increases which finalize at a maximum of $937.50 per week (or an annual salary of $48,750), which will take effect on December 31, 2020.

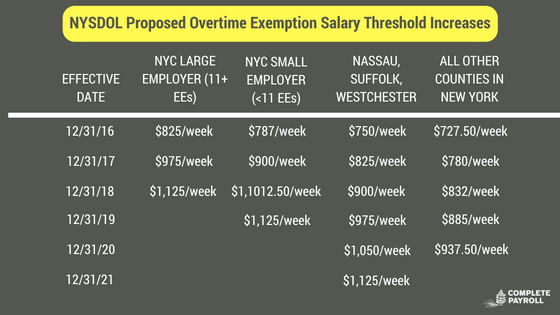

The table below provides a simple, yet comprehensive review of the incremental increases in the overtime salary threshold for all New York State employers. You'll notice the distinction between both large and small NYC employers, employers in Nassau, Suffolk and Westchester Counties, as well as employers throughout the rest of New York State.

|

Effective Date |

NYC Large Employers (11 employees or more) | NYC Small Employers (10 employees or fewer) | Employers in Nassau, Suffolk and Westchester | Employers in All Other NYS Counties |

| 12/31/16 | $825/week | $787/week | $750/week | $727.50/week |

| 12/31/17 | $975/week | $900/week | $825/week | $780/week |

| 12/31/18 | $1,125/week | $1,012.50/week | $900/week | $832/week |

| 12/31/19 | $1,125/week | $975/week | $885/week | |

| 12/31/20 | $1,050/week | $937.50/week | ||

| 12/31/21 | $1,125/week |

Helpful Articles

Overtime Salary Case Study

What does this mean for employers?

Many employers can look at the table above and quickly notice they're currently employing white-collar, salaried workers at a wage that's below what their overtime salary threshold is scheduled to increase to.

Let's try an example... You're an advertising agency in Buffalo. Last summer you hired a junior copywriter out of college; let's call her Anna. Anna's salary is $40,000 per year, which calculates to $769.23 per week. Anna is currently a salaried employee, and she is exempt. Right now, everything works.

However, on December 31, 2018, the overtime salary threshold will increase to $832 per week - $62.77 per week more than Anna's current weekly wages. That means, according to the New York State Department of Labor because her wages fall below the threshold, you're required to pay Anna overtime (1.5 times her hourly wage) for any hours worked over 40 in a given week. You also know that Anna probably works between 45 and 50 hours a week. For the purpose of this example, we'll take the average and assume Anna works 47.5 hours per week. What are your options?

Option 1: Have Anna track her hours. Don't allow her to work more than 40 hours per week.

This could seem like the simplest fix, but at best this still requires implementing a new timekeeping process. Usually, the most effective way to accomplish that is to adopt a workplace timekeeping system, allowing Anna to punch in and out. At worst, this could have major implications for your business if Anna's sudden reduction in hours makes it harder to complete projects for clients and has an overall negative impact on productivity.

Option 2: Transition Anna to hourly and pay her overtime.

At Anna's wage of $769.23 per week, you're currently paying her $19.23 per hour. We calculate that simply by dividing her weekly wage by 40. (However, since Anna is actually working 47.5 hours per week, practically her hourly pay rate is $16.19 per hour. This is fine, as long as the calculated hourly rate remains below minimum wage.) At the standard overtime rate of 1.5 times the normal hourly rate, Anna's overtime pay rate calculates to $28.85 per hour. Assuming Anna continues to work 47.5 hours per week, that means you should expect to pay Anna an additional 7.5 hours per week at her overtime rate, bringing her average overtime pay to $216.35 per week. When you add that to her currently weekly (salaried) wage of $769.23 per week, suddenly you're paying Anna $985.58 per week. That calculates to $51,250 annually, so you've just given Anna a raise of $11,250 annually, more than 25%.

Option 3: Simply raise Anna's salary above the new overtime salary threshold.

When the overtime salary threshold in Buffalo (located in Erie County) increases from $780 per week to $832 per week on December 31, 2018, you could simply increase her weekly wage above the threshold, to $833 per week. This would give Anna a raise of $63.77 per week and $3,316.04 annually, bringing her annual salary up to $43,316.04. This would represent a fairly sizeable raise of about 8.2%, but it does present some upside. Not only is it less costly than Option 2, but it would also allow you to keep Anna as an exempt employee on salary, and prevent you from having to have Anna track her time and either cap her weekly hours at 40 and/or pay substantial overtime wages.

Review

In Anna's case, most employers are likely to choose option 3. But Anna is just one example. Options 1 and 2 can be more favorable for different employees with different circumstances. How much you're currently paying them, how many hours they're actually working and their likelihood to adopt a new process like tracking their time without much resistance all play into the decisions that employers must make. And this is just one example. The complexity of adjusting for the new overtime salary threshold increases is compounded when employers need to take several employees into consideration. Regardless, there are always solutions. And whether those solutions involve pay increases, adjustments in employee classifications, and/or installing new timekeeping systems, Complete Payroll has the chops to help you get it done in the best way possible for your business.

Get Help Paying Your Employees

Payroll isn't just about paying your employees the right amount, on time, every time. It's also about tax withholding, worker classification and labor law compliance. When you think about it, most of your critical employee data flows through payroll. So it's imperative that your payroll partner knows the laws in and out and is able to help you every step of the way.

Over the last 26+ years, Complete Payroll has helped thousands of employers pay millions of employees properly and lawfully. So all you have to do is focus on what you do best. To learn more about our payroll processing services and to request a price quote or software demo, simply click the button below.

Arden Neubauer

"Hunt Hollow Ski Club has tried other payroll companies from time to time, but always return to Complete Payroll because we have an assigned specialist who knows our needs inside and out, is knowledgeable, easy to reach and very responsive. My questions and concerns are addressed in a VERY timely manner and I never feel that I have to handle sticky issues alone."

Bahar Uttam

I have been working with Lacy Smart and her team for the last few years. I have been impressed by her responsiveness, accuracy, and high level of providing client satisfaction. She and her team are a wonderful testament to the organization!

Bobby Luu

Ashley from Complete Payroll has always been helpful. It seems that whenever we have a challenge, Ashley is there to help us through and does it well. Her customer service skills are excellent.

Bonnie Deneef

I have worked with a few different payroll providers during my career. Complete Payroll is absolutely, by far, the most proficient and customer service-oriented provider I have been privileged to work with. Lindsay Ezard goes above and beyond to assist me with any question I may have. Thank You Lindsay!

Carol Grover

The team at Complete Payroll is always responsive, always helpful, and always professional. They have gone above and beyond over recent years to assist Keuka College in creating efficiencies, maintaining compliance, and improving processes. Complete Payroll is a trusted partner, a valued resource, and a respected adviser.

Cathie Rene

My experience with Complete Payroll has been exceptional. I was a novice to payroll so my learning curve was big. Andrea is wonderful helping me navigate payroll and not just fixing my errors but explaining what I did or did not do.

Cathy Pace

Finger Lakes Wrestling Club Inc

We were referred to Complete Payroll years ago by a board member and haven't looked back since. When I first started working with them, I knew nothing about payroll. My first rep Lacey, and now JoAnn, are great to work with. Working with Complete Payroll has just been a wonderful all-around experience for me.

Cathy Schuth

We very much appreciate the quick service. If I need a special report it arrives via email within one business day, if not that day.

Christina Wagar

Dr. Christopher Mozrall

Complete Payroll is a great payroll company, and we love Lacey! She always has the answers to my questions without hesitation. There is very little (if any) wait time to get a call back.

Colleen Koll

The first suggestion I made after I joined Shear Ego was that if they were not yet using Complete Payroll, they should be. We continue to be impressed and happy with the quality and friendliness of service, and the excellent newsletters and up-to-date information on all things payroll and HR.

Debbie Klymkow

We moved to Complete Payroll about 3 years ago. It was seamless and working with Lacy Smart on Mondays is a breeze.

Diane Romano

ROMOLD Inc.

People do business with people, not with corporations. In over 20 years, we have only had two customer service reps. Instead of feeling like we are one of 10,000, CP makes us feel like family! We count on Lindsay getting it right, and she always does. Even when we go outside the box, all is as we expect it!

Dick Eakins

Norco Farms

Complete Payroll fits my budget, I never get bounced around between customer service reps, and it's very easy to enter my payroll. I simply take a photo of my payroll sheet and email it to my rep. There's never a problem! With them, it's business done, and business done right.

Don Cunningham

Complete Payroll Processing provided an easy transition from internal payroll processing. With payroll as their core competency, CP has the expertise to help mitigate errors and ease the burden of annual updates. Comprehensive reporting gives all the details needed and an organization can operate with an added piece of mind knowing that the payroll service is taken care of.

Eileen Reeves

After nearly 10 years, we are receiving the same or better service than when we started. The ability to reach our dedicated customer service representative in a timely manner is huge when there are deadlines in play. Requests for unique reports and integration with our other vendors has been handled without hesitation. We truly feel a partnership with Complete Payroll.

Elmira Dewes

Elite Roasters

I am very happy with your service and your website is easy to use. Employees are so responsive and ready to help with any questions. Andrea responds quickly to email, Tracy did everything from the beginning to get us started understanding and entering payroll, and Sydney's training was just super helpful.

Emily Wyse

I just love Lindsay! She does an awesome job! She is very responsive and I like that she teaches me how to find things rather than just doing it for me.

Geri Vitullo

When our business began in 2005 I knew right away which payroll company we would use. I have had exactly 2 payroll specialists since then, and I feel like they know me & our company. I am not shy to ask questions & if they don't know the answer I am always pointed in the right direction. I have every confidence in my payroll specialist, Lindsay and the company she is with!

Gwen Jones

Mack's Body Shop, Inc.

I have had the great pleasure of working with Payroll Country for almost two years now. Tiffany was my original CSR and was very helpful, courteous, and was always there whenever I needed help. So far, my experience with my new rep, John, has been wonderful as well. I look forward to working with Complete Payroll for many years to come!

Howard Clarke

H Clarke Services

We have been with Complete Payroll for quite awhile now and plan on staying. Thanks!

Watch Howard's Testimonial

Jeff Allen

Crossroads House has been using Complete Payroll for several years now. Their service is fast, friendly and accurate. Whenever we have payroll documentation needs arise for our employees, Complete Payroll always gets the job done quickly and efficiently. We are proud to count them as one of our many community partners.

Jill Bonnell

We have received excellent and attentive service for over 10 years now. We have come to rely on Complete Payroll's consistency and very low turnover. We appreciate the chance to know our rep and they get to know us and our needs as a business. If we have payroll or general HR questions, Complete Payroll has the answers for us.

Joanna Bates

Great customer service combined with a reduction in processing fees made the decision to stay with Complete Payroll an easy one. Our customer service representative, Kendall, always gets back to us quickly, and she is always very helpful and friendly. Also, the training that we received from LeeAnn was thorough and beneficial.

John Worth

We have been well served by Complete Payroll. When we have needed support, it was given both in payroll and other employee matters, like handbooks.

Judy Mcdonald

Antonucci Law Firm

It has been great working with everyone from Complete payroll. Everyone through the years have always been great. They take your phone calls every time, and always go above and beyond what you need. We have been customers for years and will continue for years.

Kelly Stephenson

We have been using Complete Payroll for over five years and have found them to be responsive, professional, friendly, and cost effective. Customer service is best judged when something goes wrong. Complete Payroll is always there immediately to help fix the issue. Complete Payroll is a payroll partner, not just a payroll service.

Linda Moore

Tiffany Transportation Services LTD.

I have worked with many payroll companies throughout my career and Complete Payroll surpasses them all in personalized service. My CSR is Andrea and I have always received assistance in a timely manner. Keep up the great job!

Lisa Carpenter

Olean Wholesale Grocery Coop., Inc.

Complete Payroll is the best choice that I have made for our payroll and HR services. Anytime I have called customer service, there is always a happy and knowledgeable person on the line to help us out! They have done anything I have asked of them in a quick and efficient manner! I would recommend them to anybody!

Nancy Woolver

Financial Service Company

What I love most about Complete Payroll is the quick resolution and response. There are not many issues, but like anything in life, issues happen. Complete Payroll is the best at acknowledging the issue and resolving the problem quickly. My rep is fantastic to work with, and I refer Complete Payroll whenever I can!

Paul Cronk

I've been very pleased with the service and responsiveness of my CSR, and CP's continued dedication to provide us with all the tools we need to have a successful payroll and HR experience. You are always available when I have a question and always make sure that any problems that arise are worked through to my satisfaction.

Paul Martin

Elite Armed Response Service, LLC

I can not fully express my satisfaction with Complete Payroll's personalized service, directed to my specific business needs. They are always there to make suggestions on how to make my experience better. I highly recommend Complete Payroll to anyone that has a business, large or small. You will not be disappointed!

Shane Gustafson

Complete Payroll has, by far, been the easiest and friendliest company we have ever worked with. They are quick to respond to any questions I am having, and they also have a great pricing structure.

Shivaugn Ahern

The attention to detail in the customer experience and the consistent friendliness of the Complete Payroll team really make the difference. Liz, Mona, LeeAnne, Brandi, and Lacy have all been great to work with.

Sue Horn

Brian Horn's Auto Repair, Inc.

Complete Payroll's service, loyalty, and family atmosphere is second to none! We NEVER have any mistakes, and payroll is always on time. When I have a "Brain Fart" and forget to call in payroll, my rep Lindsey has my back. Our company will always be with Complete Payroll, and I recommend them to anyone who asks. They get an A++ rating in our book!

Susan Munsch

We couldn't be happier with Complete Payroll's service. Prompt and professional, every concern or question is addressed immediately. Our rep Lacy is an absolute pleasure to deal with. We have every intention to continue our working relationship with them for years to come. It is a load off to know that this part of our business is "worry free."

Teresa Bullock

We have been in business for 70 years and have dealt with A LOT of other payroll companies! Complete Payroll is by far the best we have worked with! Ashlee Adams is my CSR and she is absolutely the BEST! Always makes time for me and very patient with any question that I may have!

Teresa Jackson

We have been customers for many years. Evolution Software is easy to use but, more importantly, Cindy is an email away and her knowledgeable, efficient, and quick to replies to our questions are appreciated. We're very happy with Complete Payroll.

Tina Canali

Complete Payroll is always there if we have a problem or need something special! Their response time is AWESOME!

Denni Harbaugh

My CSR, Andi Dimmick, is The Bomb! She's always friendly, cheery, and with all her clients, makes me feel like she has carved time out for ME. Her customer service is AWESOME, and the personal touch means so much!

Elvira Aletta

Everyone I talk to at CP is friendly and tries to help. If they don't have a ready answer, that's OK. They take the time to find one. Website is user friendly, too. The actual operation of payroll is dependable and reliable.

Theone Kalkinis

Peregrine Walton LLC

On the ball with pertinent payroll and HR topics - love the payroll system and customer service!

Peter Varlan

Things go quite smoothly and I have a very good rep: Megan!

Norlene Boone

Kari Sutton and her team always are there ready to help me with any questions or concerns. The reports are easy to read and complete with the data I need for the job! Thank you, Kari!

Cindy Van Buren

Great customer support and service!

Bob Bolt

Easy to use! My rep, Ashlee Adams gives great customer service, and I love the options you have while still being affordable.

Joanne Hooven

LeeAnn was very helpful, very thorough, patient, and professional, and pleasant! She is an excellent trainer!

Gregory Geraci

Jack of All Trades

Leanne was very helpful!

Rachelle Lyons

JD Burkhardt, Inc.

LeeAnne was very helpful in explaining the program with me and answered all my questions. I look forward to trying it out on my own next week!

Lisa Lyons

Attica Auto Supply Inc

Friendly, answered all my questions, and never felt hurried.

Bonnie DeNeef

LeeAnn was just wonderful to work with.

Recent Articles from the Blog

We're constantly publishing content about payroll, human resources or anything related to managing your people.

Subscribe to Our Newsletter

Twice a month we share relevant and timely blog articles and other resources. No solicitations. No funny business. Just quality stuff to help employers.

Is your payroll or HR situation anything less than perfect?